As per reports, around September 2021, New Jersey saw a rising number of residential damages due to flooding in the area. Every year, natural disasters tend to damage homes and property, causing financial and psychological distress to residents.

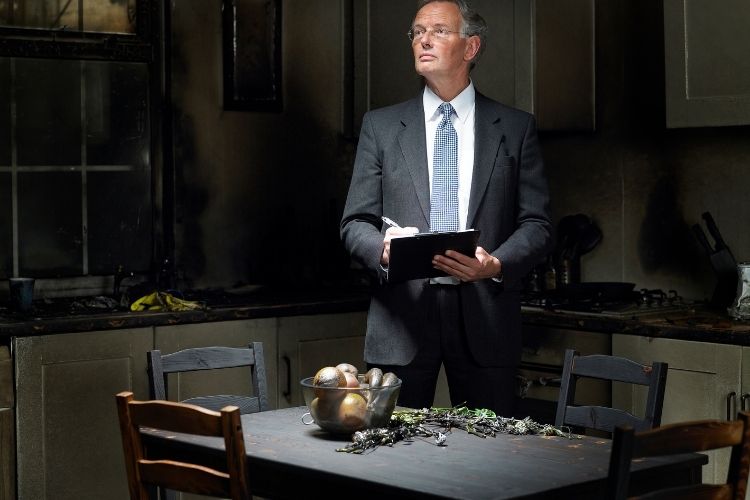

If your home or property has suffered damages, it is crucial to seek the help of a public adjuster when filing a claim with your insurance company.

A public adjuster NJ will help you file a damage claim and get the most money possible from your insurance company. They typically work on a commission basis, so they are vested in getting you the most money possible from your claim.

However, not all public adjusters are the same. So, it is vital to do the research before hiring one to represent you. Read ahead to know about the benefits of hiring a public adjuster and how to find the best one in New Jersey.

Benefits of Hiring a Public Adjuster

• Public adjusters specialize in insurance claims.

•A public adjuster will help you receive the most money by negotiating with your insurance company.

• Hiring a public adjuster will also show the insurance company that they cannot lowball you.

5 Tips to Finding the Best Public Adjuster

As per statistics, in 2020, New Jersey had 471,323 single-family homes under category five storm risk. This means your NJ home is at serious risk of getting damaged in case of a storm.

In case anything happens, finding the right public adjuster can help you recover the insurance claim without much hassle. Here are 5 tips to help you find the best public adjuster in NJ to handle your damage claim.

Ask Around

Your best bet for finding a good public adjuster is to ask around. Talk to your friends, family, and neighbors – they may have had a positive experience with a public adjuster in the past. And if you don’t know anyone who has used one, there are plenty of online resources that can help you find a reputable public adjuster. It is vital to find someone who has experience dealing with your type of claim.

Do Your Research

Before hiring a public adjuster, be sure to do your research. Read online reviews and compare different public adjusters’ rates. It’s essential to find someone who is qualified and affordable.

Make sure the public adjuster you choose has a lot of experience dealing with insurance companies and knows how to get the most money for your claim. This is especially important if your home has suffered significant damages.

Interview Potential Candidates

Don’t just hire the first public adjuster you come across. Schedule a consultation with multiple candidates so you can interview them and get a feel for their personalities. This is an important decision, and you want to make sure you’re comfortable with the person you’re hiring.

Ask each public adjuster about their experience, how they would handle your claim, and how much they charge. Also, be sure to ask for references so you can follow up and make sure they’re reputable. It’s also a good idea to check with the Better Business Bureau to see if there have been any complaints filed against them.

Check The Credentials

When looking for a public adjuster in New Jersey, it’s essential to make sure they are licensed and insured. All public adjusters in the United States must be approved by the state they operate.

You can verify a public adjuster’s license on the National Association of Insurance Commissioners website. Find their credentials with the Better Business Bureau and get their NAPIA number. This will help you ensure that you’re hiring a qualified professional.

Get A Contract

Once you’ve found a public adjuster you want to work with, be sure to get a contract signed. This will ensure that both parties are in full agreement, and that there will be no misunderstandings down the road.

The contract should include the public adjuster’s fee structure, as well as what they will and will not do. Be sure to read the contract carefully before signing it. Also, make sure you understand everything in the contract. This is a binding agreement, so don’t sign it if you don’t understand it.

Final Words

When it comes to your home or property, don’t leave anything to chance. Hiring a public adjuster in New Jersey can be a lifesaver when filing a damage claim. By following these tips, you’ll be sure to find the best public adjuster for your needs. You’re in good hands with an experienced professional on your side.

Table of Contents